In India, ensuring financial security for a girl child’s future has always been a top priority for parents. The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme specifically designed to help parents secure their daughter’s future. Launched as part of the Beti Bachao, Beti Padhao initiative, SSY offers high interest rates, tax benefits, and long-term wealth accumulation. This scheme is a great way for parents to build a substantial financial corpus that can be utilized for their daughter’s higher education, marriage, or other significant milestones in life. In this article, we will explore everything about Sukanya Samriddhi Yojana and its benefits, eligibility, interest rates, withdrawal rules, and how to open an account.

What is Sukanya Samriddhi Yojana?

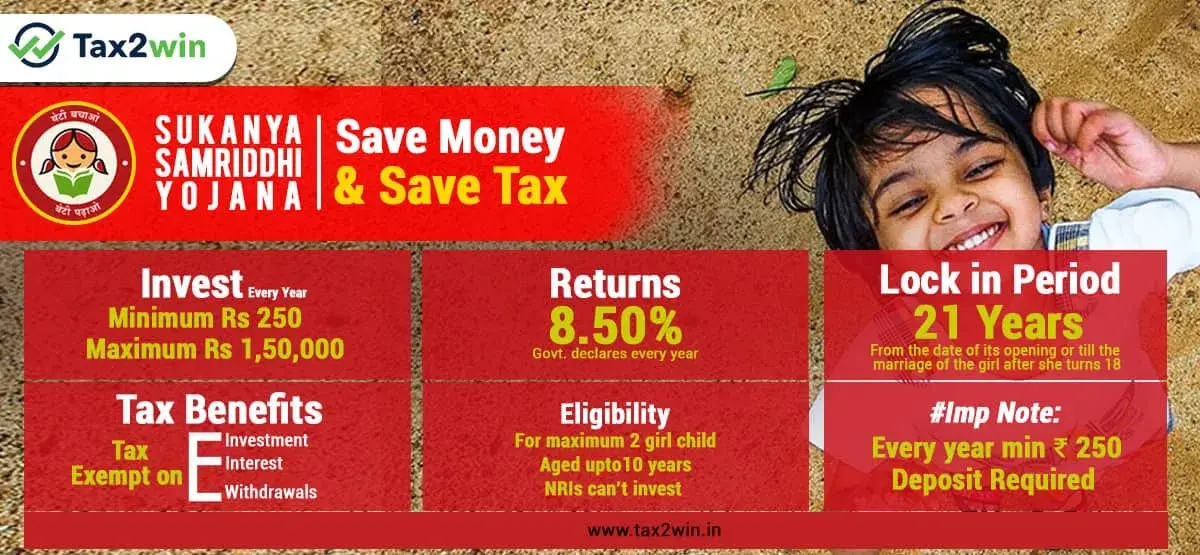

Sukanya Samriddhi Yojana (SSY) is a small savings scheme launched by the Indian government to encourage parents to save for their daughter’s higher education and marriage. It offers one of the highest interest rates among other government-backed schemes and comes with tax benefits under Section 80C of the Income Tax Act. This initiative was introduced to ensure that financial constraints do not become an obstacle to a girl’s education and future aspirations.

Key Features of Sukanya Samriddhi Yojana

· Exclusive for girl children (Only parents or legal guardians can open an account, ensuring financial security from an early stage).

· Long-term savings plan (Maturity period: 21 years or until the girl turns 18 and gets married, promoting financial discipline and long-term wealth creation).

· Tax benefits (Exempt-Exempt-Exempt or EEE tax status, making it a tax-efficient investment).

· High interest rates (Revised quarterly by the government, ensuring competitive returns compared to traditional savings options).

· Partial withdrawal allowed (For education or marriage after age 18, ensuring funds are available when needed most).

· Can be opened at any post office or authorized bank, making it accessible to everyone, even in rural areas.

· Minimum yearly deposit requirement to keep the account active, encouraging consistent savings.

· Guaranteed returns backed by the Indian government, making it one of the safest investment options.

Why is Sukanya Samriddhi Yojana Important?

Financial planning for a child’s future is crucial, and SSY ensures:

· A disciplined savings approach for parents, ensuring they systematically invest for their daughter’s future.

· Sufficient funds for higher education and marriage, helping to ease financial burdens later in life.

· Long-term wealth accumulation with tax-free interest, maximizing the growth potential of savings.

· A sense of financial independence for the girl child, empowering her to pursue her dreams without financial constraints.

Eligibility Criteria for Sukanya Samriddhi Yojana

To open an SSY account, the following eligibility criteria must be met:

1. Who Can Open the Account?

· Parents or legal guardians of a girl child.

· The girl child must be an Indian citizen.

· The girl should be below 10 years of age at the time of account opening.

2. Number of Accounts Allowed

· One SSY account per girl child.

· A family can open a maximum of two accounts (for two daughters).

· In case of twins or triplets, exceptions may be granted, allowing families to secure savings for all their children.

Interest Rates for Sukanya Samriddhi Yojana

The interest rate on SSY accounts is one of the highest among all small savings schemes. It is revised by the government every quarter to keep it competitive with market rates.

For instance, in the financial year 2023, the interest rate for April to June, July to September, and October to December was maintained at 8.0% per annum. This high rate of return ensures that the money deposited in the account grows substantially over time, making it an attractive investment option for long-term savings.

How Interest is Calculated?

· Interest is compounded annually and credited to the account.

· If deposits are made before the 10th of each month, interest is calculated for that month as well, ensuring maximum returns.

Sukanya Samriddhi Yojana Deposit Rules

Parents or guardians need to adhere to certain deposit rules when maintaining an SSY account. The minimum deposit amount required to keep the account active is ₹250 per year, ensuring accessibility to families from all income levels. On the other hand, the maximum deposit allowed per year is ₹1.5 lakh, allowing parents to invest substantially in their daughter’s future.

The deposit duration for an SSY account is 15 years from the date of opening, after which no additional deposits are required, but the account will continue earning interest until maturity. The maturity period of the account is 21 years, making it a long-term financial planning tool for parents.

If a depositor fails to contribute the minimum required amount in a financial year, the account is marked as inactive. However, it can be reactivated by paying a penalty of ₹50 per year along with the minimum deposit, ensuring that parents do not lose out on this valuable opportunity.

Withdrawal Rules of Sukanya Samriddhi Yojana

1. Partial Withdrawal for Higher Education

· After the girl turns 18 years old, up to 50% of the balance can be withdrawn.

· This withdrawal must be used for education expenses, and proof of admission must be provided, ensuring funds are used for the right purpose.

2. Full Withdrawal on Maturity

· The SSY account matures after 21 years.

· The full amount, including interest, can be withdrawn by the account holder (girl child) at that time, allowing her financial independence.

3. Premature Closure

· Allowed only under special circumstances, such as death of the account holder or extreme financial hardship (subject to approval), ensuring the account serves its intended purpose.

How to Open a Sukanya Samriddhi Yojana Account?

The SSY account can be opened at any post office or authorized bank by following these simple steps:

1. Visit the nearest post office or participating bank branch.

2. Fill out the Sukanya Samriddhi Yojana account opening form.

3. Submit the following documents:

· Birth certificate of the girl child.

· Identity proof (Aadhaar, PAN card) of parents/guardians.

· Address proof (Aadhaar, passport, utility bills, etc.).

4. Deposit the initial amount (Minimum ₹250).

5. The account is opened, and a passbook is provided for future transactions, ensuring transparency.

Conclusion

Sukanya Samriddhi Yojana is one of the best financial instruments to secure a girl child’s future in India. It not only provides high interest rates and tax benefits but also ensures that the savings are used for education and marriage expenses. While it has a long lock-in period, it remains one of the most rewarding investment options for parents planning for their daughter’s future.

If you are a parent or guardian of a girl child, consider opening an SSY account today and start building a bright future for her.